Cancelling your registration will remove your access to the event. If you proceed, you will no longer be able to participate or access event-related materials.

Deleting your account will remove your access to the event.

Need Technical Assistance? ✉ tech@vfairs.com

Join us at the Africa Investor Summit - the ultimate platform for growth and success. Unite, Innovate, and Invest with top industry leaders, entrepreneurs, and investors at #AIS2021. This two-day conference is the perfect opportunity to network, learn, and stay ahead of the game in the fast-paced world of business in Africa. Don't miss out on this chance to gain valuable insights, build connections, and take your business to the next level. Register now and secure your spot at the Africa Investor Summit - where the future of Africa's economy is being shaped. See you there!

Welcome to the Africa Investor Summit - the ultimate platform for growth and success. Unite with industry leaders, innovate with cutting-edge ideas, and invest in your future at #AIS2021. Join us on November 28-29, 2024 for the most anticipated conference of the year. With expert speakers, interactive workshops, and valuable networking opportunities, this is an event you won't want to miss. Don't just take our word for it, come and experience the power of collaboration and inspiration firsthand. Register now and be a part of the next wave of innovation and investment in Africa.

19:00

19:00

View Info

Hide Info

All ticket holders are invited to kick-off #AESIS2024 with our opening cocktail at Allure Rooftop 71 Waterkant St, Cape Town, thanks to our partners with 22 On Sloane, African Angel Academy and GSMA.

Please note, this gathering has a limited capacity so we will be ensuring registration at the door, so make sure you RSVP here before the list closes. The event begins at 7pm.

We look forward to welcoming you!

08:30

08:30

View Info

Hide Info

Networking, a meet-and-greet breakfast for delegates of AESIS, with an opportunity to connect with and hear from notable personalities in the early stage investment ecosystem.

09:30

09:30

Fadilah Tchoumba

ABAN

ABAN

09:35

09:35

View Info

Hide Info

Access to capital to power early stage companies

Tomi Davis

ABAN

ABAN

09:50

09:50

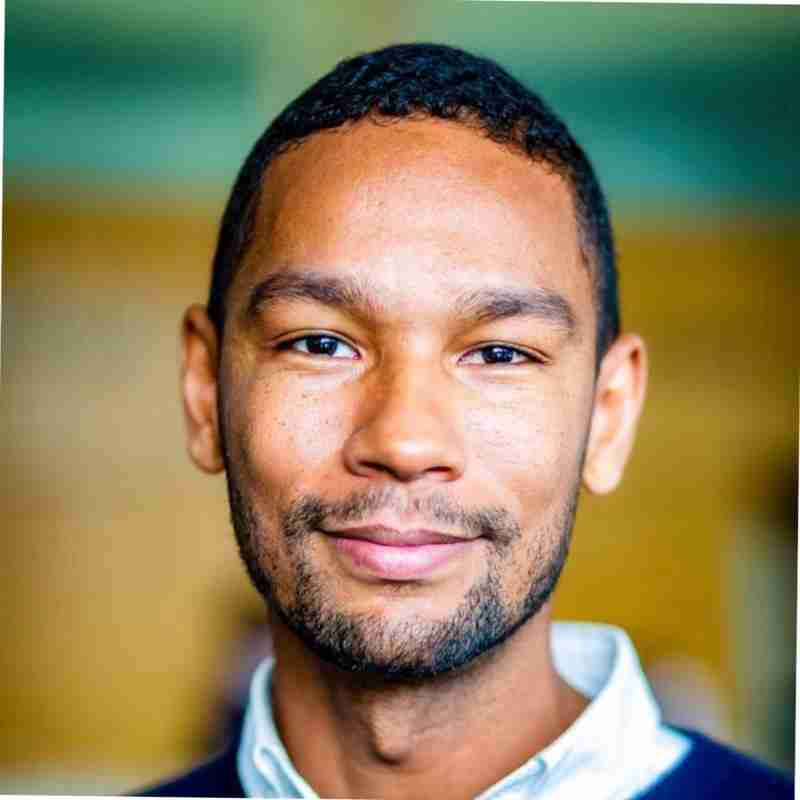

Melvyn Lubega

Breega

Breega

10:00

10:00

Phuthi Mahanyele-Dabengwa

Naspers

Naspers

10:15

10:15

View Info

Hide Info

A presentation of the most recent data that reflects the performance and growth of the African early stage investment ecosystem, followed by a discussion with leading investors to highlight the key drivers of growth, address main challenges and add their contribution towards pioneering new pathways in early stage capital mobilization.

Dario Giuliani

Briter Bridges

Briter Bridges

Nonnie Burbidge

Untapped Global

Untapped Global

Joel Nana Kontchou

Makoe Ventures

Makoe Ventures

10:45

10:45

View Info

Hide Info

How can startups attract the attention of equity investors during a low funding cycle? Under very limited funding conditions, how can operational excellence help?

Mike Mompi

Enza Capital

Enza Capital

Zachariah George

Launch Africa

Launch Africa

Kevin Simmons

Loft Inc.

Loft Inc.

Franziska Reh

Uncap

Uncap

Egla Ntumba

MsFiT Ventures

MsFiT Ventures

11:25

11:25

11:45

11:45

View Info

Hide Info

An honest conversation. Over mentored? Over-trained? and under funded... Let’s unpack where the disconnect truly lies.

Eghosa Omoigui

Echo VC

Echo VC

Yemi Keri

Rising Tide Africa

Rising Tide Africa

Pauline Koelbl

ShEquity

ShEquity

Aly El Shalakany

54 Collective

54 Collective

12:25

12:25

View Info

Hide Info

This dialogue will focus on the perspectives, strategies, and contributions of LPs and GPs, exploring how they engage with and influence the investment ecosystem in Africa.

David Van Dijk

Boost Africa

Boost Africa

Damilola Thompson

Diligence Africa

Diligence Africa

Justin James

Fireball Capital

Fireball Capital

Julia Stausberg-Umuerri

DEG

DEG

Meit Ghandi

FMO Ventures

FMO Ventures

13:05

13:05

View Info

Hide Info

Harnessing Africa’s demographic dividend through Investment, capitalizing on Africa’s youthful population and growing consumer base .

Lawrence Eta

13:15

13:15

14:40

14:40

View Info

Hide Info

An in-depth analysis of the survey results, encouraging a collaborative exploration of their implications and applications in the angel investing landscape. Offering actionable insights and fostering a dialogue on how the findings can be used to inform investment strategies, support start-ups, and shape the future of angel investing.

Tomi Davis

ABAN

ABAN

Thuli Montana

Briter Bridges

Briter Bridges

Alexandra Fraser

Viridian

Viridian

Julia Kho

Triple Jump, DGGF

Triple Jump, DGGF

Anthony William Catt

Ventures 54

Ventures 54

14:40

14:40

View Info

Hide Info

A look at the evolving landscape of capital market policies, exploring recent updates and their implications for investors and startups. The dialogue will also tackle ongoing challenges, including regulatory hurdles, market volatility, and access to capital, particularly in emerging markets.

Elizabeth Howard

Lelapa, WAI, ACfA

Lelapa, WAI, ACfA

Joe Kinvi

Hoaq

Hoaq

Eghosa Omoigui

Echo VC

Echo VC

Oswald Osaretin Guobadia

DigitA

DigitA

15:25

15:25

View Info

Hide Info

A more recent wave of innovation in the African early stage investment ecosystem is the approach of providing more than just capital, with more intentional and structured involvement in both pipeline development and portfolio support towards exit. This session will explore the models that investors are using to build platforms around early stage investing.

Aly El Shalakany

54 Collective

54 Collective

Martin Warioba

Warioba Ventures

Warioba Ventures

Pedro Bandeira

Y Angels (Core Angels International)

Y Angels (Core Angels International)

Yannick Gayama

Double Feather Partners

Double Feather Partners

Olatokunbo Ige

Jonh Maxwell Team

Jonh Maxwell Team

15:25

15:25

View Info

Hide Info

We will look at how global investors and diaspora communities can collaborate with local stakeholders to enhance the effectiveness of capital mobilization efforts.

Ben White

VC4A

VC4A

Fridah Ntarangwi

ZidiCircle

ZidiCircle

Francis Omorojie

Ennovate Ventures

Ennovate Ventures

Claire Nyambori

FMO

FMO

17:00

17:00

View Info

Hide Info

Curated Farm To Table Tasting Experience With Storytelling.

GIZ SAIS invite you to celebrate fresh, locally sourced ingredients and the stories behind them. Each dish, crafted by award-winning chef of Emazulwini, Mmabatho Molefe, her maverick food pays homage to her heritage and represents an exciting new approach to South African cuisine and is paired with tales of sustainable farming, offering a flavorful journey from field to plate. Experience an evening where food and storytelling connect for a truly immersive dining adventure.

We will be providing transport. Please be at reception at 5pm as we will be leaving at 5:15.

17:00

17:00

View Info

Hide Info

Get ready to party at Skyline Mixer with FMO ventures and Friends(Breega, CAIF, LoftyInc Capital And TLcom Capital)! Kick back with cool drinks, epic city views, and a crowd of investors, founders, and trailblazers. As the sun sets, the energy heats up – it's all about music, mingling, and making unforgettable connections.

Bring your best vibe and dance moves!

*this event will be taking place at the Radisson Red Rooftop on the V&A Waterfront which is walking distance from the summit venue. Please meet at the reception area at 5. We will be walking from here at 5:15.

17:00

17:00

View Info

Hide Info

Join Digital Africa and Disraptor for a relaxed Padel and Pizza evening! After a productive day, unwind with some friendly games on the padel court, great conversations, and delicious pizza. It’s the perfect chance to connect, recharge, and have fun together in a laid-back setting.

*this will be taking place at The Bay Hotel, Camps Bay. Transportation will be provided to the event but not back from the event.

17:00

17:00

View Info

Hide Info

Set sail on a sundowner cruise with Enza Capital, fellow investors, entrepreneurs, and industry leaders for an evening of networking and meaningful conversations against a stunning sunset backdrop. This relaxed yet engaging cruise offers a unique opportunity to discuss capital, share insights, and explore potential partnerships all while enjoying the views and the company of like-minded peers. Don’t miss this chance to unwind, connect, and set the stage for impactful collaborations.

*Meet at the reception at 5. We will then walk to the boat at 5:15 as we will be setting sail promptly at 6.

08:30

08:30

View Info

Hide Info

Networking, a meet-and-greet breakfast for delegates of AESIS with an opportunity to connect with and hear from notable personalities in the early stage investment ecosystem.

09:30

09:30

Nicola Tyler

The Thinking Company

The Thinking Company

09:40

09:40

View Info

Hide Info

The She Wins Africa Program, an IFC initiative, implemented by VC4A is supporting 100 female-led African companies to get access to funding. Selected ventures from the cohort, with proven traction and innovative solutions, will present their businesses’ opportunities. Don’t miss the chance to support closing the gender gap for African companies. The ventures pitching include: Advantage Health Africa, Yellow Factoring, Farmio Limited, Eshandi, Agriarche, Paycard SA and GoBEBA. Please check under the 'Venture Booth' Section to find out more.

10:05

10:05

Emmanuel Adegboye

Madica

Madica

10:25

10:25

11:10

11:10

View Info

Hide Info

Partner investors bring 3 of their portfolio companies to pitch on stage to other investors for collaboration, co-investment and follow-on investment. The venture include Terraa, Rhea and SwiftVEE. Please visit the venture booth section to find out more.

11:35

11:35

12:00

12:00

View Info

Hide Info

Partner investors bring 3 of their portfolio companies to pitch on stage to other investors for collaboration, co-investment and follow-on investment.

12:25

12:25

View Info

Hide Info

Ennovate Ventures will bring 3 of their portfolio companies to pitch on stage to other investors for collaboration, co-investment and follow-on investment. The venture on stage will be: Sema SpeakApp, Lima Africa, Swahilies. Please go to the venture booth section to find out more.

12:50

12:50

View Info

Hide Info

Partner investors bring 3 of their portfolio companies to pitch on stage to other investors for collaboration, co-investment and follow-on investment.

Niklas Fisher

develoPPP Ventures

develoPPP Ventures

13:15

13:15

14:30

14:30

View Info

Hide Info

What is the state of exits and secondary buy-outs in Africa? As the market matures, secondary buy-outs are gaining prominence. How are key players—venture hubs, angel investors, and VC funds—shaping the journey from founding to exit?

Zachariah George

Launch Africa

Launch Africa

Ido Sum

TLcom Capital

TLcom Capital

Thomas Van Halen

VC4A

VC4A

Wanji Ng'ang'a

Acumen

Acumen

14:30

14:30

View Info

Hide Info

Do global mandates define or respond to African capital allocation needs? DFIs are critical contributors to the African early stage investment ecosystem, both as a fund of funds and direct investors. This will be an honest debate about the nature of the influence of global mandates on capital allocation patterns in Africa.

David Van Dijk

Boost Africa

Boost Africa

Rachel Crawford

VilCap

VilCap

Kenza Lahlou

Outlierz

Outlierz

Fabrice Perez

Proparco

Proparco

Abu Cassim

VC4A

VC4A

14:30

14:30

View Info

Hide Info

An exploration of the innovations in the African early stage investment ecosystem that have unlocked gender lens capital. A closer look at female-focused investments.

Hlengiwe Makhathini

IDF Capital

IDF Capital

Kristen Wilson

Innovate Africa Fund

Innovate Africa Fund

Christine Namara

Flat6Labs

Flat6Labs

Ayodele Ogunnoiki

2xGlobal

2xGlobal

15:15

15:15

View Info

Hide Info

Do local mandates define or respond to African capital allocation needs? Who are the critical contributors to the African early-stage to late stage investment ecosystem. This will be an honest debate about the nature of the influence of global and local mandates on capital allocation patterns in Africa.

Fadilah Tchoumba

ABAN

ABAN

Jean Marie Kanaura

KIFC

KIFC

Sinazo Sibisi

Timbuktoo

Timbuktoo

Abraham Itule

Safiri

Safiri

15:15

15:15

View Info

Hide Info

Explore the policy levers that can be leveraged to advance gender lens investing. A look into the advantages and shortcomings of startup acts to advance the gender lens agenda.

Elizabeth Howard

Lelapa, WAI, ACfA

Lelapa, WAI, ACfA

Michelle Matthews

Viridian

Viridian

Mark Kleyner

Dream VC

Dream VC

Thea Sokolowski

Women Who Build Africa

Women Who Build Africa

15:15

15:15

View Info

Hide Info

Exploring advanced strategies for leveraging public-private partnerships (PPPs) as a powerful tool for capital mobilization. Beyond foundational concepts, this session delves into how PPPs can provide long-term stability and scalability, offering insights on structuring partnerships that drive sustained growth.

Bertil Van Vugt

VC4A

VC4A

Joanne Manda

Timbuktoo

Timbuktoo

Lawrence Eta

Niklas Fisher

develoPPP Ventures

develoPPP Ventures

16:00

16:00

View Info

Hide Info

Explore the dynamic tension between driving positive social impact and achieving financial returns in high-impact/high potential sectors. This session dives into the heart of development-focused investments: Is it possible to balance purpose with profit? Are unique approaches needed across different high impact areas?

Tomi Davis

ABAN

ABAN

Pauline Koelbl

ShEquity

ShEquity

Andrew Darge

E3

E3

Alexis Grosskopf

Ocean Hub Africa

Ocean Hub Africa

16:00

16:00

View Info

Hide Info

How can innovative models foster greater collaboration between investors and development stakeholders to address gender disparities? This discussion will uncover how strategic, gender-focused partnerships can unlock new opportunities for sustainable growth and positive change in Africa.

Fares Seaidi

GIZ SAIS

GIZ SAIS

Martin Karanja

GSMA

GSMA

Lisa Thomas

Susan Nakami

Village Capital

Village Capital

Stephen Gugu

Viktoria Ventures

Viktoria Ventures

18:00

18:00

View Info

Hide Info

Theme: Honoring Excellence in African Early-Stage Investment

The Africa Early Stage Investor Awards is a prestigious initiative aimed at celebrating outstanding achievements within the African early-stage investment ecosystem. This awards event is dedicated to recognizing the visionary investors, pioneering funds, angel networks, and ecosystem enablers who have made exceptional contributions to building and nurturing the continent’s startup landscape.

The AESIS Awards will spotlight the individuals and organizations whose passion, strategic insight, and support have transformed startups into thriving enterprises that stimulate economic growth, create jobs, and empower communities.

2xGlobal

READ BIO2xGlobal

Viktoria Ventures

READ BIOViktoria Ventures

Acumen

READ BIOAcumen

Safiri

Timbuktoo

READ BIOTimbuktoo

Village Capital

READ BIOVillage Capital

FMO

READ BIOFMO

Flat6Labs

The Thinking Company

FMO Ventures

VC4A

VC4A

READ BIOVC4A

KIFC

READ BIOKIFC

Women Who Build Africa

READ BIOWomen Who Build Africa

GSMA

READ BIOGSMA

Breega

READ BIOBreega

DigitA

READ BIODigitA

Fireball Capital

READ BIOFireball Capital

Makoe Ventures

Untapped Global

READ BIOUntapped Global

Uncap

READ BIOUncap

Naspers

develoPPP Ventures

READ BIOdeveloPPP Ventures

Ocean Hub Africa

READ BIOOcean Hub Africa

E3

READ BIOE3

Proparco

Outlierz

READ BIOOutlierz

VilCap

READ BIOVilCap

GIZ SAIS

Dream VC

READ BIODream VC

Viridian

READ BIOViridian

MsFiT Ventures

READ BIOMsFiT Ventures

IDF Capital

READ BIOIDF Capital

DEG

READ BIODEG

Timbuktoo

READ BIOTimbuktoo

VC4A

READ BIOVC4A

TLcom Capital

READ BIOTLcom Capital

Madica

READ BIOMadica

Jonh Maxwell Team

READ BIOJonh Maxwell Team

Double Feather Partners

READ BIODouble Feather Partners

Y Angels (Core Angels International)

READ BIOY Angels (Core Angels International)

Warioba Ventures

READ BIOWarioba Ventures

54 Collective

READ BIO54 Collective

READ BIO

Triple Jump, DGGF

READ BIOTriple Jump, DGGF

Viridian

READ BIOViridian

Briter Bridges

READ BIOBriter Bridges

Ennovate Ventures

ZidiCircle

READ BIOZidiCircle

VC4A

READ BIOVC4A

Hoaq

READ BIOHoaq

Lelapa, WAI, ACfA

READ BIOLelapa, WAI, ACfA

Diligence Africa

Boost Africa

ShEquity

READ BIOShEquity

Rising Tide Africa

Echo VC

READ BIOEcho VC

Loft Inc.

READ BIOLoft Inc.

Innovate Africa Fund

READ BIOInnovate Africa Fund

Launch Africa

READ BIOLaunch Africa

Enza Capital

READ BIOEnza Capital

Briter Bridges

ABAN

READ BIOABAN

ABAN

READ BIOABAN

Ventures 54

READ BIOVentures 54

Join industry experts for insightful sessions and networking opportunities.

Discover career-changing opportunities with top companies at our event.

Register now and unlock exclusive access to workshops and keynotes

Tell your event story through images

Tell your event story through images

Tell your event story through images

Tell your event story through images

Tell your event story through images

Tell your event story through images

Tell your event story through images

Tell your event story through images